Prominent management guru, Dr. Stephen Covey in his highly acclaimed book, ‘7 Habits Of Highly Effective People’ stresses some principles for personal growth, which are meant for life in general, a life that is beyond those monotonous office desks and business graphs. The seven habits mentioned in the book including being proactive, putting first things first, think win-win are some from the lot, are surely the standards to a complete, successful life. Now, this makes us wonder what can be the habits that make a great and effective teacher and after much research, we bring to you some habits that are surely the traits of an effective teacher. Read on to find out what are those habits that can make you a good teacher.

Process and Generate Payslips for your Employees using Fedena

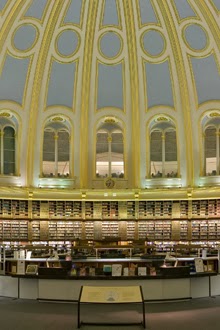

10 Best Libraries in the World

What comes to your mind when you hear the word ‘library’? The information it gives, right? While there are people who take libraries as a place to get all the information required, be it for school projects, for personal research or any work assignments. But for many others, it’s a heaven for them to sit and spent hours among books. So, whatever is the reason for your visit to a library, see below which are the best libraries in the world.

Automate the Calculation of Tax and Expenses with Fedena’s Auto Transaction Feature

Any amount coming to your institute is always an income; but at times, you might have to pay tax and cess for the amount that you receive. It really becomes a tough task when you have to calculate the certain percentage on the amount every time it is received. But, when your school is powered by Fedena, you should not worry about all these trivial issues. The Auto Transaction feature of Fedena helps you set a percentage that you want to divide as a tax on the amount received as income. Hence, you enter the amount you received as an income, and go to report which will display the final income received after deducting the percentage of tax as expenses.

- Firstly, login to your Fedena account and go to ‘More’ and then to ‘Finance’ and finally to ‘Automatic Transactions’. Once you are in ‘Automatic Transactions’, you need to create a new auto transaction.

- Write the category, percentage of amount to be deducted and also the description of the transaction you are creating. After creating a new transaction, you need to go back to ‘Finance’ and then to ‘Transactions’ to create a new income event and see how the tax is being deducted.

- Click on ‘Add income’ and you get a page where you have to fill in all necessary details in order to create the new income.

- When you ‘Save’, you are allowed to go back to ‘Transactions’ and get the report for which you need to select the time limit for which you need the report. You get the report that will show the tax or any cess has been deducted and the final amount that you receive as income.

- Thus, you have a smarter way to calculate taxes and cess to get the final income after deduction. Then, why use critical mathematical calculations for it?

From Maths Class on Yahoo Doodle to a Free World-class Education for Everyone – Khan Academy

|

Fedena now available in Google® Apps Marketplace

http://www.youtube.com/watch?feature=player_embedded&v=nL32kmZGO-M

.jpg)